CASH COW FUND

Your Self-Directed Auto-Traded Personal Hedge Fund

We are targeting returns of 30-40% per year for this conservative low-risk low-cost strategy

This is a fully automated trading system members can subscribe to with a low cost and low risk design.

The strategy behind the fund is to trade specially researched stocks that are more likely than not to go up in price over a 10-20 day period prior to an earnings release. We call them “pre-jumps” and some of these picks may qualify for our more aggressive “PRO Jumpers Fund, but not always. This is a LONG-ONLY strategy. There are no short trades, so its suitable for an IRA (401k or cash account). We have been trading this strategy since October 2017 and its up over 300% for its cumulative trades. See the spreadsheet below for details on each trade and the overall ROI.

The CASH COW FUND is low-cost and lowered risk strategy that is now a 100% Auto-Traded strategy. We no longer provide advanced signals via Twitter as it can be tracked and risk managed directly on a members auto-trading site.

ACCEPTING NEW MEMBERS AUGUST 1, 2019

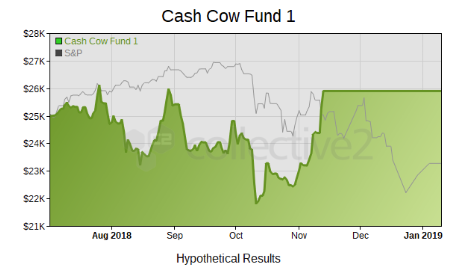

We started the original CASH COW Fund with 50k (see below) which was a signals only system for our members. When we made this an exclusive auto-trading system in July 2018 – we reduced the size of the fund (essential starting a new one) to 25k. The strategy requires and a minimum investment of 5k and can be scaled so it perfectly mirrors the Fund percentage wise.

CASH COW HISTORY – PORTFOLIO / SPREADSHEET (prior to auto-trading)

The Trade Allocation for this portfolio account is $10,000 per trade. It could be $1,000 or $500. The idea is to use to same trade allocation (in dollars) vs randomly buying shares as many undisciplined traders do. The shares in this example are rounded up or down so the final net P&L may vary slightly buts close to 10k per trade. The idea is to trade a consistent allocation amount. Open trades are noted below with with current P/L and a closing signal will be posted here and sent on the Twitter signal line.

Notes: A= trade was normal and we exited on the target date as published. B=the target released early or take profit was early (based on our trajectory and other news) and we had to issue a trade alert and alter our planned close time. C= our data suggested to stay in the trade longer (though this is a personal trading decision, the rule is to still close prior to release date (if this is an earnings reporter target).

DISCLAIMER YOU SHOULD READ: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will, or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand loss or adhere to a particular trading program in spite of trading losses are material points (both psychological and financial) which can adversely affect actual trading results.

There are numerous factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Trading volatile events can be one of the riskiest forms of investments available in the financial markets and suitable for only sophisticated individuals and institutions. The possibility exists that you could sustain a substantial loss of funds and possibly all of your account, therefore you should not invest money that you cannot afford to lose. Nothing in this presentation is a recommendation to buy or sell stocks, futures or currencies and StockJumpers or any of its affiliates are not liable for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of StockJumpers reports or reliance on such information. Before deciding to participate in the markets, you should carefully consider your investment objectives, level of experience and risk appetite.