Trade Plan: SELL (before market close)

Here is what happened:

(click to expand)

Commentary: Quite an interesting trade, even with our analysis being spot on. Here is what we said cut out from the Jump Report —

We suggested FIT would beat estimates (which they did soundly) but that forward guidance would be very weak. It was. The stock was beaten down the last few months, but trading through-out the day was robust and positive. Option action favored Calls and the underlying stock rose 6% from open on the possibility of a significant earnings beat, and also because it was over-sold and ready for some good news. Well, enter StockJumpers Trajectory analysis tools, and we turned all that on its head. Our study revealed that despite the possibility of showing off great numbers (both top and bottom) that any market reaction would still be negative. It was.

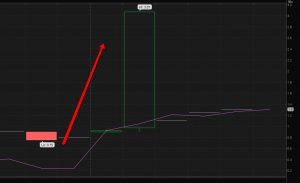

At market close FIT was trading at 16.49 and then at the moment of the release for a few seconds it popped up to 17.8 (knee jerk response to the .35 beat) and then tanked. And it kept tanking. All the way down to a low of 13.3 ( A whopping 19.3%). Beating the street on earnings doesn’t guarantee the stock price will rise… especially in today’s fickle market.

The bigger question is even with our short call (which was stellar) – some members may have gotten stopped on initial pop up – which hit 6%+. I would think most stop orders didn’t get filled however, as things moved so quick that if you blinked you didn’t even see the pop. FIT was destined to tank… as soon as reality sunk in. We will talk extensively about this trade at this weeks training webinar on Thursday… so if you ARE one of unlucky few that got stopped-please join us – I want to hear from you.

Jump Zone Profit: 19.3%

(Stay tuned…more to come on this trade.

We are testing our new options strategy using the StockJumpers technology

UPDATE: 2/23/16 The price seems to have bottomed out at 13.17 and is bouncing back a bit. We tested our new StockJumpers Options Trading Strategy on this one – looking at out of the money PUTS (March 16 – $14 Strikes). Here is the chart as of this morning. Another great profit bucket…

Options can be difficult to trade with this data – and its certainly an advanced strategy that is not for everyone. We will be offering Options Trading trajectory analysis soon as part of the new PRO – Unlimited membership. Check out the Announcements page. Options trading and KNOWING the outcome is where the big boys play and the monthly membership fee is mere lunch money compared to the returns potential