Weekly Recap – 7 Jump Trades Total (5 Winners – 2 Losers). An interesting week, as we are settling in with doing more targets and refining our data sets. As every trader knows there are nuances to most every trade. In fact for most professional Trader’s its all about the nuance making many trades per event, and being nimble enough to spot the opportunities as they present themselves and use the StockJumpers data as your intelligence backdrop. Newbie traders often don’t move fast enough, and even with StockJumpers data – lose the trade. OK, lets drill down on these 7 trades with special attention to the nuance of the move.

Jump 1 first —

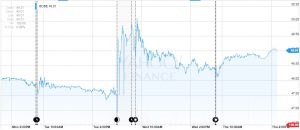

Jump 1

ADBE was a good directional call, which dropped 3% initially and then held around 2% for the next 24hrs. Not a big mover that we expected…but still a good call on the immediate jump and who can really complain about 3% profit in 10 minutes. The second play here was to go long at the bottom of the drop and ride the retrace back up over the next several days.

What we reported

What really happened

Jump 2

BOBE was a clean miss, we had it as a down move. It jumped down a little initially but as the trade played out it retraced up and ended up being a nice long play. We bombed this one.

What we reported

What really happened

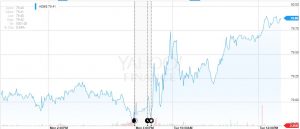

Jump 3

LZB this was a good call – but another tough trade. It immediately jumped down 6% (which is what our data suggested) and then popped back up over close the next day. The nimble trader would get both directions. Our overall recommendation was the safer bet – which was to wait for the drop and then go long – which was the solid play. But had you played the initial drop you would have made money too.

What we reported

What really happened

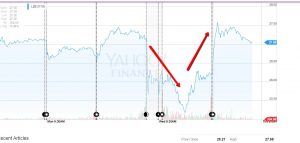

Jump 4

PIR was a hit, and another nuance trade, that required nimble reflexes. The recommendation we reported was “…may be an initial pop up due to better than expected news, however this is still a down play overall….watch for the pop before shorting” Being nimble is the key to day trading, as not all trades play out perfectly and pay off big immediately.. the timing is critical. Right after the news it jumped down 6% and then popped up another 6%. This is where the optimum short play was aftermarket. Short and then ride it down the next day. Even if you went short right at close, you would have done OK, but following the data yielded a better payday. A great 11% Jump zone was the pay out on this one.

What we reported

What really happened

Jump 5

ORCL was a clear and obvious miss. We reported this as up, and it did the opposite and immediately dropped 6%. Our second total bomb for the week.

What we reported

What really happened

Jump 6

RHT was hit. We reported this a SELL even though we knew the numbers were solid and it would certainly bounce back, the market reaction was a forecast. it was a small play down with only a 4% drop, a fast in and out. RHT is a great example of taking profit quick as it retraced back quickly and the following day was a long play.

What we reported

What really happened

Jump 6

SWHC was a solid classic Jump play. It made a fast 7% in 20 minutes. A great trade and a nice end to the week.

What we reported

What really happened

Overall it was an OK week, but we can do better. Better picks. Better calls. More Jump trades that don’t require nimble fingers. Lets’ see what next week brings!