Weekly Recap – 8 trades Total (7 Winners – 1 Loser)

The week came in with a bomb and left with a bang. Like all Jumps some did better than others but overall – the net gain for this weeks positive Jump Zone potential resulted in a plus of 41%.

Here is how it all went down…

Jump 1

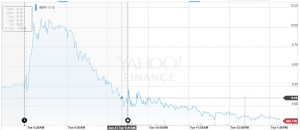

SONC (Sonic, Inc) We got blasted on the first jump. It was however our only loser for the week.

Here is what we reported.

Here is what happened.

Jump 2

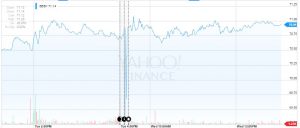

BBRY (BlackBerry, Ltd) This was a before market play, and though it had an immediate pop up as you can see the classic trendline down unfolded as forecast

Here is what we reported.

Here is what happened.

Jump 3

BBBY (Bed Bath & Beyond, Inc) The initial down happened with a 4.4% move, with a whipsaw up of about 1.5% at first. Then it retraced back over the next two days to where it started. Certainly not the best trade of the week, but had you gotten out at the bottom a respectable profit.

Here is what we reported.

Here is what happened.

Jump 4

LEN (Lennar Corp). The builder reported better than the Street expected as we predicted it would and this was a solid and clean jump play that yielded a perfect 6% profit just as markets opened.

Here is what we reported.

Here is what happened.

Jump 5

APOG (Apogee Enterprises, Inc) was a fun trade. One of those opportunities to have it both ways. We reported an initial down move and then a retrace back up in the same session and it played out exactly that way. The down move made a 12.4% profit and then at the bottom it was a perfect slow climb out that made back another 13+%. Of course in the perfect world, you made a ton of profit in both trades even though its unlikely. But this was one where having the Jump Report data and trading it exactly – really payed off.

Here is what we reported.

Here is what happened.

Jump 6

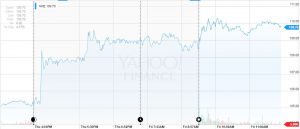

NKE (Nike) This was a solid play. The earnings release was exactly as anticipated, and the stock immediately jumped up 4+% and continued its trend the next day. Not dramatic but solid. This one was also an excellent Options player.

Here is what we reported.

Here is what happened.

MU (Micron Technologies). This took the Street by surprise – but not StockJumpers. We called it correctly as a short play – and recommended a SELL before market closed.. and it did not disappoint. There was a whipsaw up initially of a couple % points but as investors realized the miss, it quickly fell and kept on falling thoughout the aftermarket sesssion and the next trading day. The final bloodbath on this one was a 19% down move and hitting the lowest price level of the year. StockJumpers rode and broke this bronc all the way into the ground. We sold and stayed in and are glad we did.

Here is what we reported.

Here is what happened.

Jump 7

That’s it. Next week will be less intense as we roll into Independence Day. Markets closed Friday and most folks are talking a long weekend stretching through Monday.

With more Jumps added to the schedule, make sure you are getting all your reports and good trading.